|

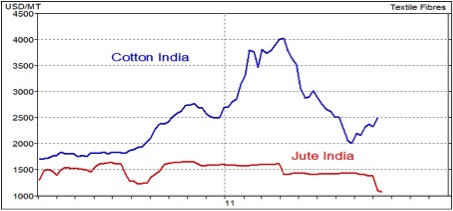

The Cotton Advisory Board has estimated production at close to 355 lakh bales for the current cotton season (October to September). That would be a new record; at textile companies, not surprisingly, the smiles are getting wider because buoyant cotton prices are expected to stabilise, improving their margins. The joker in the pack is expected to be China, which is on the prowl globally to scoop up 50 lakh bales. That could send the supply-demand arithmetic, and therefore price, askew, said experts. However, complementary weather in cotton-producing regions and modest demand growth due to the ongoing global financial crisis are seen capping upsides. Cotton prices are currently trading at around Rs38,500 per candy (of 350 kgs, Shankar-6 variety), while arrivals are 40 to 45 lakh bales per day. One bale is about 170 kg. Prices have strongly corrected over the past four to five months from a high of `60,000 per candy. ¡°We were expecting prices to correct more by Rs3,000 to Rs4,000 per candy once arrivals begin. However, this has not happened yet because there are a good number of exporters already present in the market,¡± said Vinod Arora, chairman and managing director, Aarvee Denims Ltd. Another worry is wanton exports. IJ Dhuria, corporate general manager, raw materials, Vardhman Textiles said though India is expecting a huge cotton crop, neighbouring countries such as China and Bangladesh may benefit more as the government has placed raw cotton exports in the open general licence (OGL) list, which allows for free export and import. ¡°Now, given that sea transportation is cheaper than surface, these countries could buy Indian cotton at better rates than some Indian companies,¡± Dhuria said. Due to this, he said, major margin improvements across the value chain are unlikely despite the good cotton crop. World cotton output is set to rise by 2-2.5 million tonnes by July next with the United States and India being the main contributors. This, in turn, will translate into an increase in the stock-to-consumption percentage from around 37% last year to 44% to 45% this year, Dhuria said. Textile exporters say any price correction is major relief to those with foreign clients. ¡°Exporters are facing a tough time, so cheaper cotton will help them offer products at more competitive rates. We could see a favourable improvement in margins which could reflect in the fourth quarter on the current fiscal,¡± said Rajendra Hinduja, mentor, Gokaldas Exports. But, Hinduja warns, any excess exports of raw cotton will lead to price problems. Arora from Aarvee Denims said if exports remain in the range of 50 lakh bales, domestic prices would stay in the Rs34,000 to Rs35,000 per candy range. That¡¯s the price needed for Indian exports to stay competitive, Hinduja said. For apparel manufacturers like Mandhana Industries, stability in cotton prices is the key. ¡°Due to last year¡¯s rally in prices, cotton apparels lost a lot of international ground against other manmade fibres. The good crop will help only if prices remain stable, not volatile,¡± said Manish Mandhana, joint managing director of the company. Dhiren Sheth, president, Cotton Association of India, remains confident production will be good this season too. He hopes the government won¡¯t play spoilsport by becoming in stick in the mud.

dnaindia

|

|

Amid the spindles, bounteous cotton draws smiles

Updated: 2011-10-10 Source: dnaindia

Recommended News

Photo Gallery

Most Popular